Budget 2022 and Ghana’s Public Debt: The Realism of the Plan to Achieve Debt Sustainability

In the first part of this essay, I discussed the government of Ghana’s path to achieving debt sustainability by 2025 as presented in budget 2022. Crucial to the path is realising “oil discovery-like” change in revenue. In this part of the essay, I will discuss how realistic budget 2022 is in achieving less than 70% […]

Budget 2022 and Ghana’s Public Debt: The Plan to Achieve Debt Sustainability

Ghana’s parliament approved the 2022 budget on November 30th, 2021, reversing an earlier rejection by opposition lawmakers after MPs from the majority side staged a walkout. Budget 2022 has been the most contentious in recent history. At the center of the contention is the new 1.75% levy on all electronic transactions including mobile money (Momo) […]

Tesah Capital sets up investment funds for KETASCO NSMQ finalists

Tesah Capital has set up investment accounts for finalists of National Science and Maths Quiz (NSMQ) from Keta Senior High School. The three contestants, Bright Senyo Gadzo, Francisca Lamini and James Lutterodt beat all odds to establish KETASCO as one of the most successful at the just ended 2021 NSMQ, being the first Volta-Oti team […]

2022 Budget: Projected 42.9% increment in revenue necessary for debt sustainability – Tesah Capital

Asset management company, Tesah Capital, has described as bold and necessary for debt sustainability, government’s plan to raise GHS100.5 billion in total revenue for the 2022 fiscal year. Tesah Capital notes the projected revenue which represents a 42.9 percentage points increment (GHS30.5 billion) on the 2021 revenue outturn of GHS70.34 billion will increase the revenue […]

Monetary Policy Update: Bank of Ghana increases policy rate to 14.5% in response to elevated inflationary risks

The monetary policy committee (MPC) of the Bank of Ghana (BoG) on November 22,2021 decided to increase the policy rate by 100 basis points to 14.5%. The decision at the just ended 103rd MPC meeting is the first monetary policy rate (MPR) increase since November 2015. In the MPC press release, they attributed the decision […]

Ghana Economic and Financial Market Review – 3rd Quarter 2021

Ghana’s sovereign credit ratings: should investors be concerned?

While investors especially foreigners may find it economically viable to invest in developing countries, credit quality reports that evaluate the creditworthiness of a country are considered essential for investment decisions and cannot be ignored. Ghana has maintained its sovereign credit ratings for the past three (3) years (2017-2019). The Sovereign Credit Rating (SCR) assigned to […]

Youth urged to take advantage of Covid-19

Ghanaian youth have been advised to take advantage of the post-Covid-19 era to explore their entrepreneurial capabilities. Mr Kwame Pianim, renowned economist said new opportunities and business models were emerging in the wake of Covid-19 for those who are ready. “The pandemic should rather keep us alive in the sense that business-minded citizens should take […]

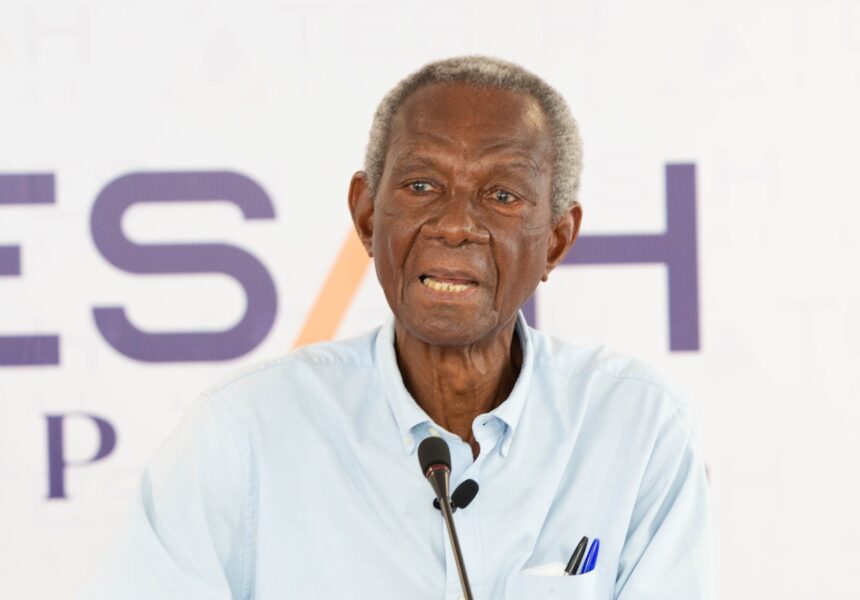

Regulators must improve investment environment – Kwame Pianim

Renowned economist Mr Kwame Pianim has recommended that regulators of the financial services industry should put in measures to improve the investment environment.He stated that the Bank of Ghana (BoG) and the Securities and Exchange Commission (SEC) could help the investing public by making it mandatory that major on-site inspection findings on going concern, governance […]

Tesah Capital Investment Dialogue: Kwame Pianim shares experience; urges gov’t to empower local businesses

Celebrated Ghanaian business economist and investment consultant, Andrews Kwame Pianim has urged the government to support local businesses to grow irrespective of the political affiliation of owners. He said entrepreneurs are national assets and must be given the push to scale up and help expand the country’s economy. Mr. Pianim shared this while speaking at […]