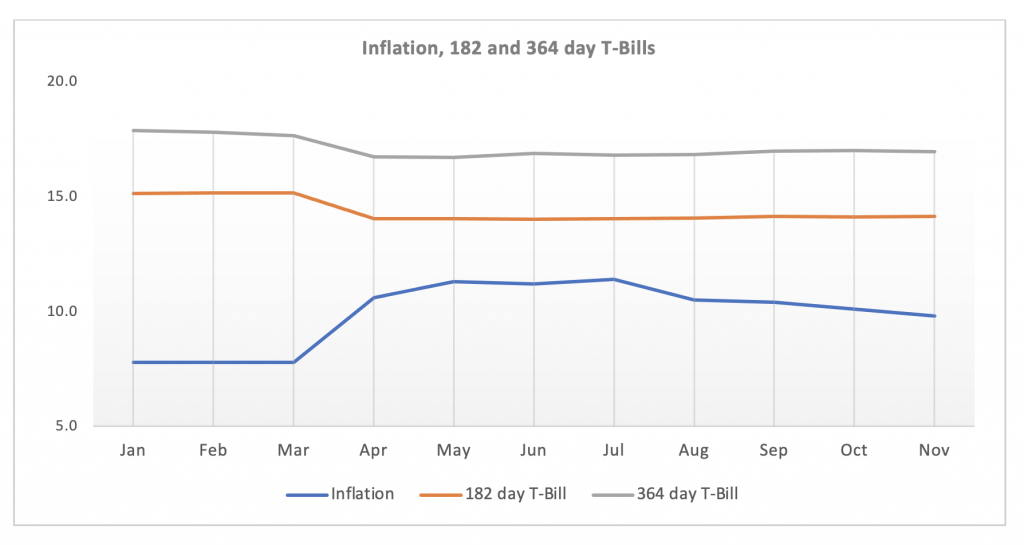

Inflation has seen a steady decline after peaking at 11.4% in July, 2020 on account of sharp price increases during the lockdown period, fueled mainly by supply chain disruptions. Inflation has since moderated to the government’s target band of 8%±2%, settling at 9.8% in November, 2020. The downward trend in inflation has been attributed to a significant drop in food inflation to 11.7% from 13.7% in July, 2020.

Inflation is projected to increase moderately in the early days of 2021 as a result of price increases emanating from activities in the festive season. Additionally, we expect a marginal upside risk to the inflation outlook from anticipated increase in utility tariffs from January, 2021 following plans by the government to end the free electricity and water relief packages by close of year 2020. We however expect these upside risks to be offset by reduction in food prices as COVID-induced surge in food inflation (which constitutes more than 50% of the inflation basket) will likely ease in 2021. Again, we do not expect crude oil price to increase significantly in the near term. “High global oil inventory levels and surplus crude oil production capacity will limit upward pressure on oil prices through much of 2021″ IEA Dec, 2020. The IEA projects crude oil to average $47-50/bbl in 2021 following OPEC’s oil production cut agreement on December 3, 2020.

The above notwithstanding, the cedi is expected to maintain its relative stability in 2021 depreciating by 5.7% on average to the US dollar. This can be attributed to market developments including the Bi-weekly Forex Forward Auctions, expected inflows of foreign investment and reserve build of US$1.3 billion as at August, 2020 (resulting from favorable commodity prices and non-traditional exports).

Relative stability in fuel price, and exchange rate amongst others emphasizes our view that inflation could end the year 2021 at the Bank of Ghana’s medium term target range of 8% ± 2% in the absence of unanticipated shocks.

The consistent drop in inflation in the last four months could drive down interest rates in the midst of high demand for treasury securities (tenders increased by 25.5% month-on-month to GHS 5.8 billion in November, 2020). Current downward trend in inflation could serve as an opportunity for the Bank of Ghana to drive down interest rates on treasury securities in the near future, given that current financing needs of the Government of Ghana (GoG) could increase the country’s debt service burden by over 50% of projected revenues in 2021.

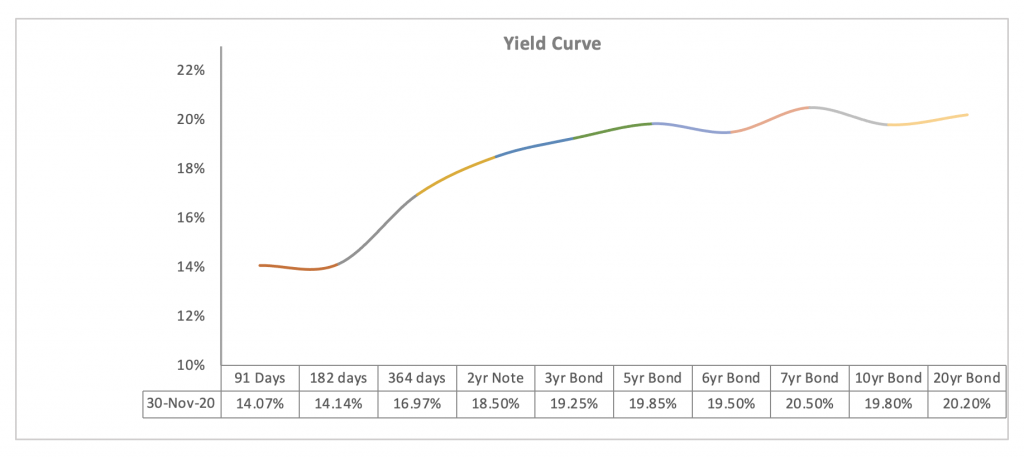

Although inflation continues to ease towards the medium-term target upper band target of 10%, there are concerns about Ghana’s rising public debt which is induced by Covid-19 related expenditure. This may cause fixed income investors to bargain for higher yields on government securities. Nonetheless, with deflationary expectations, investors’ appetite for medium to long-term securities may increase as bond prices tend to rise when inflation is decreasing. Additionally, continued presence of foreign institutional investor appetite in view of low-yielding global debt as well as relatively liquid local institutions should support the demand for GoG securities. Hence, we forecast the nominal interest rate on primary issuances to trend lower across the yield curve.