A number of listed companies on the GSE regularly pay out a portion of their profits to shareholders which is referred to as dividends. Paying dividends usually sends a message about a company’s future prospects and financial strength. Dividend payments may be in the form of cash, shares or property and are usually paid annually (once a year), bi-annually (twice a year) or quarterly (once every three months). Regular dividend payment provides investors with reinvestment opportunities for portfolio growth. Hence dividend stocks can be a great choice for investors (such as retirees) looking for regular income to add to their long-term portfolios.

Fourteen (14) companies listed on the GSE have paid dividends at least twice over the last ten years. These include Cal Bank, Ecobank Ghana, GCB Bank, Republic Bank, Standard Chartered Bank, Benso Oil Palm Plantation and Produce Buying Company. Others are FanMilk Ltd, Unilever Ghana, SIC Insurance, Enterprise Group Limited, Camelot, Ghana Oil and Total Ghana.

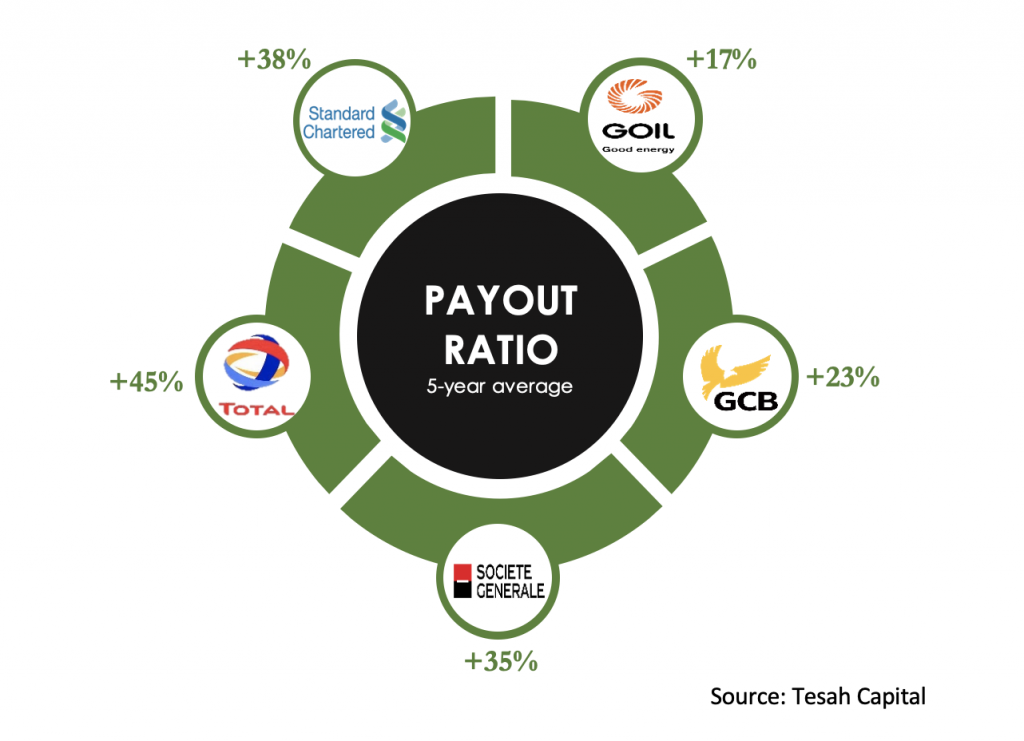

A few amongst these companies, however, have shown commitment to regular dividend payments based on their own dividend policies. These companies are well established, have remained profitable over the past decade and are well known for their long track record of paying dividends. Despite the adverse effect of the COVID pandemic on companies which necessitated the Central Bank of Ghana to suspend dividend payments, some of these companies maintained at least a 10% payout ratio.

Below is a list of stocks on the GSE with a history of consistent dividend payments.

- Ghana Oil (GOIL): the average payout ratio for GOIL over the past five years is 17% and it remains the only listed stock with a constant increase in annual dividend payout ratio. The stock’s dividend per Share (DPS) has grown by 400% from 0.01 in 2010 to 0.05 in 2019, and is expected to reach 0.08 by 2022 in the absence of unanticipated shocks.

- GCB Bank (GCB): the company has been consistent with annual dividend payments to its shareholders for the past decade, with DPS averaging an annual growth of 12% over the period. Average payout ratio for the past five years is 17%.

- TOTAL Ghana (TOTAL): Similar to GOIL, TOTAL Ghana has been forthcoming with annual dividends consistently since 2010. As shown in the snapshot below, the company’s dividend payout ratio is the highest on the exchange, averaging about 45% year-on-year.

- Societe Generale Ghana (SOGEGH): Over a 10-year period (2010-2019), the company has managed to declare annual dividends regularly except for 2014 and 2017. DPS has grown by 200% to 0.09 in 2019 from 0.03 in 2010. Average payout ratio of the bank for the past five years is 35%.

- Standard Chartered Bank (SCB): In conformity with BoG’s directive for listed banks to suspend dividend payments to help mitigate the effects of the Covid-19 pandemic in the banking sector, the board and management of SCB did not declare dividend for 2019. Except for this instance, SCB has consistently paid out dividends to shareholders. DPS has grown by 391% since 2010 with an average payout ratio of 38%.

Other Characteristics of these consistent dividend payment stocks on the GSE:

Specifically, these stocks tend to have a/an:

- Three-to-five-year earnings growth of at least 10%.

- Market Capitalization above GHS 300 million.

MTNGH is an emerging prospect of a consistent dividend stock on the GSE, as the company has repeatedly made payouts to its shareholders since its IPO in 2018. The company being the largest stock by Market Capitalization (GHS 7.87 billion) on the bourse, has seen its dividend per share as well as its earnings per share, doubling over a 5-year period (2015-2019) to 0.06 and 0.08 respectively in 2019.

SNAPSHOT SHOWING 5 YEAR AVERAGE PAYOUT RATIO FOR CONSISTENT DIVIDEND PAYING STOCKS