The Monetary Policy Committee (MPC) of the Bank of Ghana recently concluded its 111th meeting, held from March 22nd to March 24th, 2023. Following this, on March 27th, 2023, the committee issued a press release announcing a hike of 150 basis points to its key policy rate, bringing it to 29.5%. The primary reason for the increase in the key interest rate was the relatively high inflation rate, which is currently outside the medium-term target range of 6% – 10%.

While the decision to raise the interest rate has been met with mixed reactions from businesses and consumers, with borrowing-dependent businesses expressing disappointment, many economists, including ourselves, believe that the current state of the economy warrants the policy rate hike. It is worth noting that this increase follows a record 16% rise since November 2021.

Before the MPC meeting, there was a trend of central banks worldwide tightening their monetary policy stance, including major advanced economies such as the US Federal Reserve, Bank of England (BOE), and the European Central Bank (ECB). Several African central banks, including the Central Bank of Nigeria, South Africa’s Reserve Bank, Morocco’s Bank al-Maghrib, and the Egyptian Central Bank, have also raised their key interest rates.

However, businesses and consumers who expected the MPC to either reduce or maintain the policy rate at the previously held rate of 28% had valid arguments. We will discuss some of these arguments in the following paragraphs, but it is essential to note that they were not sufficient to prevent the increase in policy rate decision.

For businesses and consumers who expected the MPC to reduce or maintain the policy rate at the previously held rate of 28%, there were legitimate arguments in that regard. In what follows we discuss a few of the arguments to at least maintain the policy rate and explain why they were not sufficient to prevent an increase in policy rate decision.

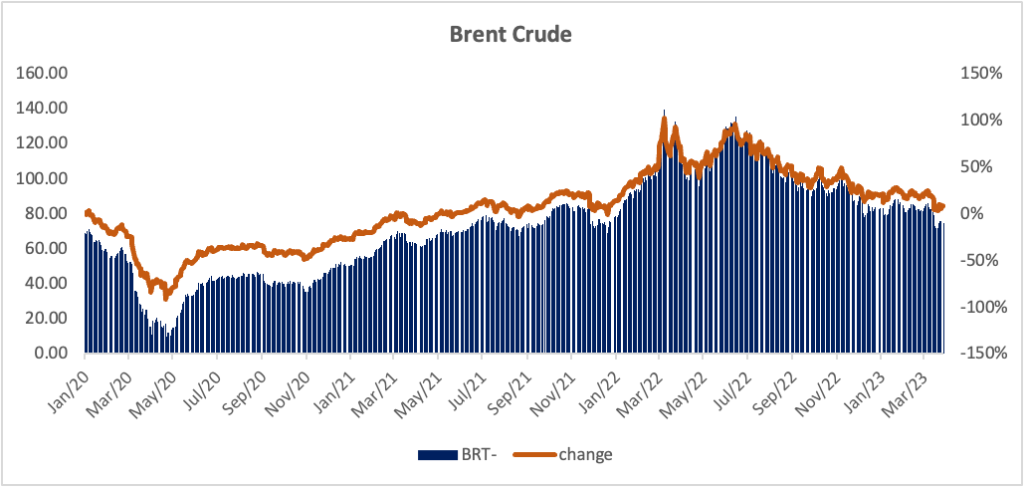

Declining crude oil prices

In the period since the last Monetary Policy Committee (MPC) meeting, crude oil prices have experienced a decline. Figure 1 illustrates that brent crude oil prices dropped from approximately $85 to about $75 within this period. Many businesses expected that this reduction in crude oil prices would significantly contribute to the reduction of transportation costs and inflation generally. However, data from the Ghana Statistical Services (GSS) shows that the cost of transportation in February 2023 increased by 70.3% from the previous year and 2.4% from the previous month. It appears that the decline in crude oil prices has not yet been fully transmitted into the economy as expected. This may be partly because of the lagged pricing window used by the National Petroleum Authority (NPA) in pricing petroleum products in the economy.

Figure 1: Crude Oil Prices

Source: Generated by Authors based on data from Refinitiv

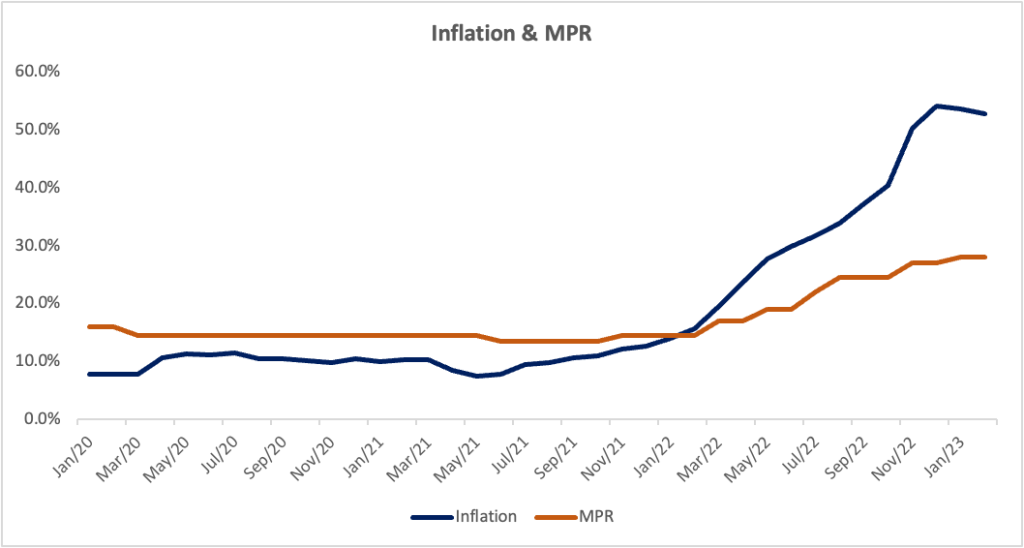

Recent disinflation

In December 2022, inflation peaked at 54.1%, but it fell to 53.1% in January and further to 52.8% in February, as indicated in Figure 2. Although it is encouraging to see a decline in inflation, it is still five times higher than the inflation target. As a central bank with the mandate to maintain price stability, the Monetary Policy Committee (MPC) would have sent the wrong signal to market participants regarding its commitment to return inflation to its target had they maintained the policy rate at that high level of inflation.

Figure 2: Inflation and Monetary Policy Rate

Source: Generated by Authors based on data from Refinitiv

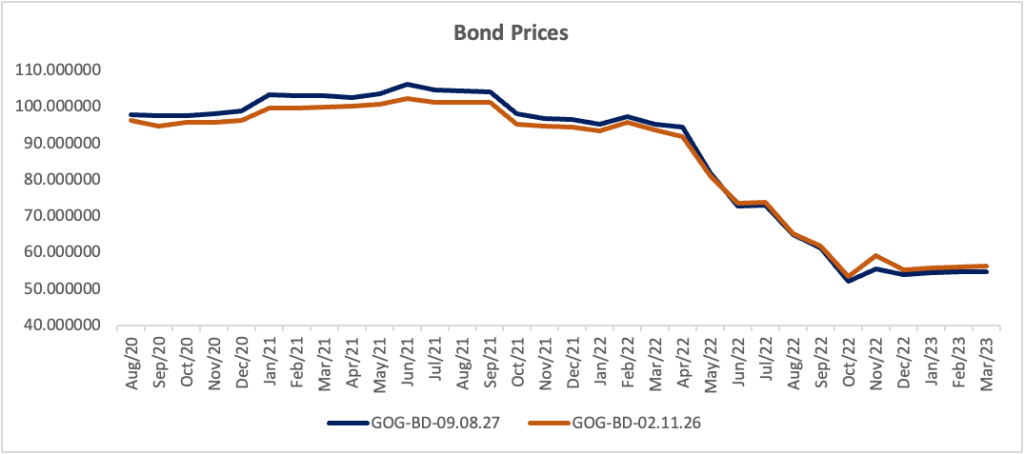

Financial instability concerns

Possible spillovers from the recent failure Silicon Valley Bank (SVB) and Signature Bank, coupled with concerns about the impact of the domestic debt exchange program (DDEP), has led to doubts about the necessity of another rate hike by the central bank. While an increase in the policy rate could help control inflation, it could also lead to higher interest rates and lower bond prices, which would reduce banks’ profitability and potentially strain the financial system. Figure 3 shows the graph of selected government of Ghana bond prices. Bond prices have been declining but has been stable since the announcement of the DDEP. If the Bank of Ghana raises its policy rate to rein in inflation, it will most likely further depress the market value of securities parked on many financial intermediaries’ balance sheet. However, we believe that financial stability objective and price stability objective should not be a trade-off for the central bank. We can understand the argument against raising policy rate when the economy is threatened with a banking crisis or a similar stability risk, yet we believe monetary policy tools are best fashioned for maintaining price stability and that other macro prudential tools could be used to address financial stability risks.

In addition, there seem to be a divergence between treasury yields and the trend of monetary policy. In particular, the rates for the 91-day and 182-day treasury bills were 35.75% and 35.81% respectively on February 6th, 2023. However, the 91-day and 182-day treasury bills were 18.53% and 21.27% respectively on 20th March 2023. We see the divergence between treasury yields and the trend in the policy rate as an anomaly in financial markets that should not necessarily prompt a policy response. Over time, we expect the treasury market to adjust in line with the trend in monetary policy.

Figure 3: Bond Prices of Some Government of Ghana Bonds

Source: Generated by Authors based on data from Refinitiv

In conclusion, the recent hike in the key policy rate by the Monetary Policy Committee (MPC) of the Bank of Ghana is a reflection of the current state of the economy and the need to maintain price stability. While businesses and consumers who expected a reduction or maintenance of the policy rate had valid arguments, such as the recent decline in crude oil prices and concerns about financial instability, these were not sufficient to prevent the increase in policy rate decision. The MPC’s decision to raise the policy rate is consistent with the trend of central banks worldwide tightening their monetary policy stance to combat inflation. As economists, we believe that monetary policy tools are best fashioned for maintaining price stability, while other macro-prudential policies can be used to address financial stability risks. The Bank of Ghana’s decision to raise the policy rate may have negative implications for borrowing-dependent businesses, but it is essential to prioritize price stability to ensure long-term economic growth and sustainability.

Written by;

Elikplimi Komla Agbloyor

Associate Professor, Department of Finance, University of Ghana Business School.

Chair of Research Committee, Tesah Capital

Data Scientist (Machine Learning and Artificial Intelligence Applications in Business)

Dennis Nsafoah

Assistant Professor of Economics, Niagara University, NY

Member of Research Committee, Tesah Capital

Joshua Adagbe

Snr. Research Analyst

Tesah Capital

With support from Emmanuel Ayim, Boakye Danquah and Dan Owusu Amponsah