Introduction

The Bank of Ghana’s Monetary Policy Committee will hold its meeting from January 24th to 27th, with a press release due on January 30th. We anticipate the policy rate, which influences various financial indicators like lending rates, fixed income yields, stock market performance, and exchange rates, to rise by 300 basis points to 30%. Our analysis and internal models suggest an MPR range of 27% to 31% with 99% confidence.

What is Happening Globally?

The Bank of Canada raised its key rate by 25 basis points to 4.5%, with the US Federal Reserve, Bank of England (BOE), and European Central Bank (ECB) all expected to follow suit during their upcoming meetings. ECB’s Christine Lagarde has cautioned that the market may not be fully prepared for the necessary rate hikes to curb inflation that has reached a 40-year high.

In Africa, South Africa’s Reserve Bank raised its key rate by 25 basis points to 7.25%, while Nigeria’s Monetary Policy Committee raised it by 100 basis points to 17.5%. Angola, on the other hand, lowered its benchmark interest rate by 150 basis points to 18%. Mozambique kept its benchmark interest rate at 17.25%.

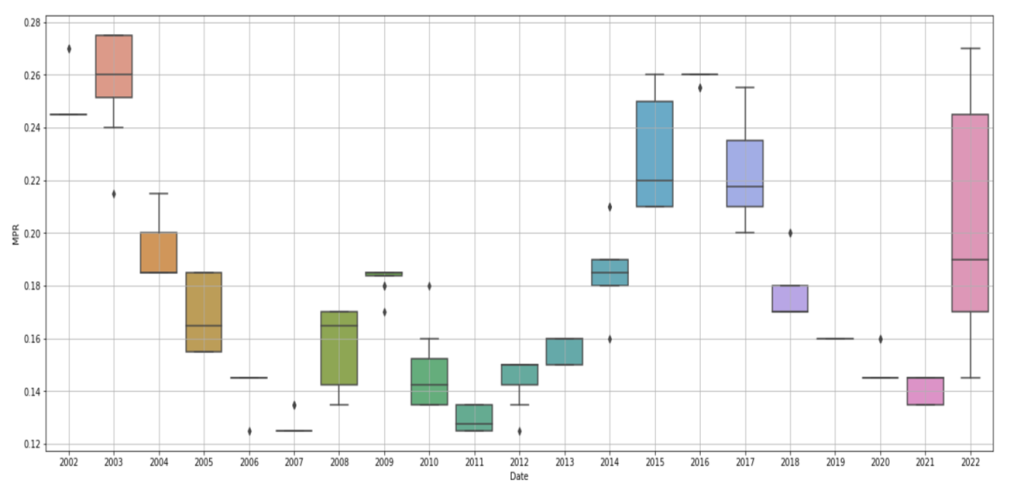

Figure 1: Yearly Variations in Ghana’s Monetary Policy Rate

Figure 1 below shows the yearly trends in the Monetary Policy Rate.

The highest policy rates occurred in 2003, 2015, 2016, 2017, and 2022, while the lowest rates were in 2006, 2007, and 2011.

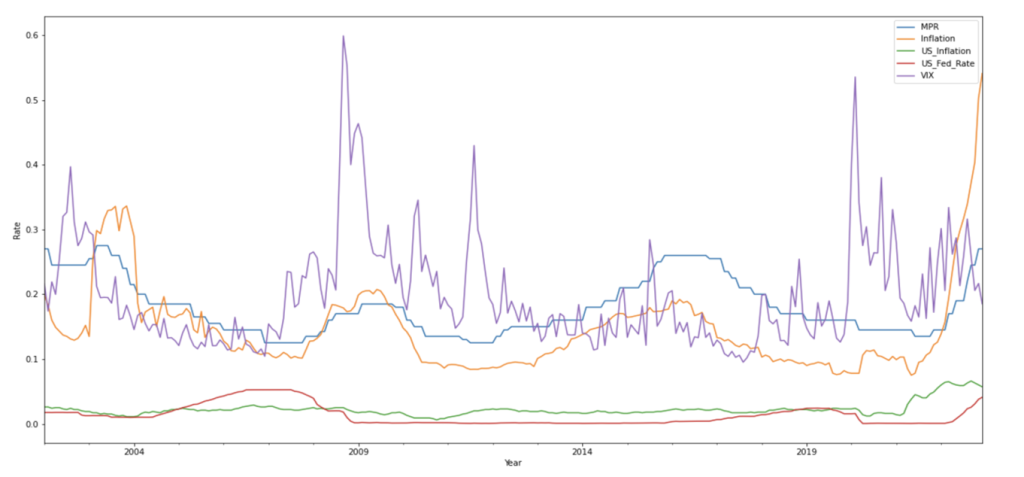

Figure 2 presents key economic indicators like the Ghana monetary policy rate (MPR), US Federal Funds rate, Ghana’s inflation, US inflation rate, and the CBOE VIX index. The average MPR from 2002 to 2022 was 18%, with a low of 12.5% and a high of 27.5%. The MPR showed a standard deviation of 4.35%. The trend of the MPR decreased from 2016 to 2020, but began to increase again in the latter half of 2021. The highest inflation rate recorded was 54.1% in 2022, with the lowest being 7.5% in 2021.

Figure 2: Trends in Key Economic Variables

Our Analysis

Since the MPC started its rate hike cycle in November 2021, it has raised the policy rate by a total of 13.50%, with a 12.50% increase in 2022 only. Meanwhile, inflation has gone up by 43.5% since November 2021, with a 41.5% increase in 2022 alone. From November 2022’s MPC meeting to now, inflation has risen by 13.7% (from 40.4% to 54.1%), with a 9.90% increase in November and a 3.8% increase in December. Figure 2 does not indicate any easing or peak of inflation. The gap between inflation and the MPR has also significantly widened since January 2022, from 15.9% at the November MPC meeting to 27.1% currently.

Our analysis and internal forecasting models suggest that the MPC will raise the monetary policy rate by 300 basis points to 30%. We anticipate the MPR to be in a range of 27% to 31% with a confidence of 99%.

Written By;

Elikplimi Komla Agbloyor

Associate Professor, Department of Finance, University of Ghana Business School.

Chair of Research Committee, Tesah Capital

Data Scientist (Machine Learning and Artificial Intelligence Applications in Business)

&

Dennis Nsafoah

Assistant Professor of Economics, Niagara University, NY

Member of Research Committee, Tesah Capital

With support from Derrick Kofi-Arthur Otoo and Dan Owusu Amponsah