Since the government of Ghana first announced that it was inviting eligible bond holders to exchange approximately GHS137.3 billion of domestic bonds for a package of new bonds on December 5th, the program deadline has been extended twice. The latest expiration date for the program is Tuesday 31st January 2023. In our previous article titled “The illusion of No Haircut: Ghana’s proposed Domestic Debt Exchange (DDE) Programmme is Worse than a 100% Haircut on Principal”, we discussed the position of an investor who held an indicative government bond. Our analysis showed that the government’s DDE proposal would reduce investor’s wealth by 67%. We also found that this reduction may even be worse than a 100% haircut on the principal if the government had kept the initial terms of the bond contract. This is true even though the DDE has largely been marketed by the government as one that does not embed any principal “haircut” on eligible bonds.

In fairness to the government, the objective of the program is to ensure debt sustainability is restored and in addition secure IMF financial assistance. In this short article, we explain how the DDE could impact the government’s 2023 budget.

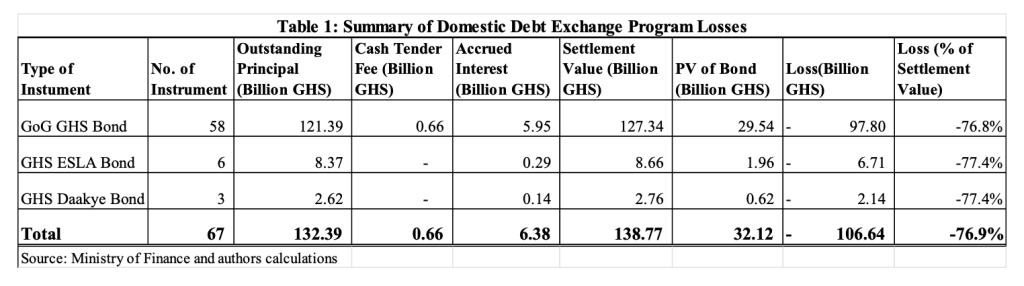

Beginning from Table 1 below, we show the impact of the losses on eligible bonds in the program as announced in the 24th December Amended and Restated Exchange Memorandum. There are three (3) classes of domestic instruments the government is seeking to restructure – the GHS-denominated bonds issued by the Republic of Ghana, GHS-denominated Bonds issued by E.S.L.A Plc and the GHS-denominated Bonds issued by Daakye Trust Plc. In all, 67 instruments with a total outstanding principal of GHS 132.39 billion are subject to the invitation to exchange. As proposed by the government, a 2% cash tender fee will be paid only on eligible bonds maturing in 2023 on the settlement date. This sums to GHS 662 million. Using the proposed consideration ratios and financial terms of the new bonds proposed in the 24th December Amended and Restated Exchange Memorandum, we calculated the present value of all 67 eligible bonds. In our computation, we assumed a yield to maturity of 35.9% equivalent to current yield on government of Ghana treasury bills. We found that the DDE as proposed reduces the settlement value by GHS106 billion, approximately 77% of the settlement value.

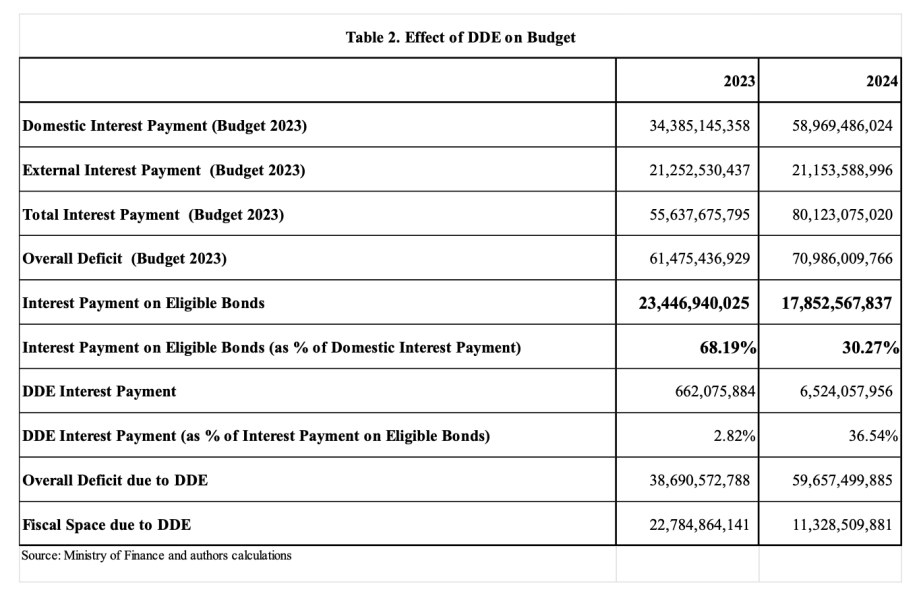

In table 2, we show how the domestic debt exchange programme affects the government’s budget assuming full participating by all eligible bond holders. In the budget 2023, the government allocated GHS34 billion to pay interest on domestic debt. Out of this GHS34 billion, the government in the absence of the DDE would have paid GHS23 billion as interest on the eligible bonds. This implies that interest payments on eligible bonds as a percentage of all domestic interest payment is approximately 68%.

Since the government, through the DDE, is seeking to defer and reduce coupon payments on eligible bonds, only GHS662 million of the GHS23 billion would be paid as interest should the government receive full participation in the DDE. The GHS662 million in reality is the 2% cash tender fees on the 2023 eligible bonds. This has enormous implications on the budget for the government of Ghana. The government in the 2023 budget had an overall fiscal deficit of GHS61 billion. Should bond holders agree to the terms of the DDE, the overall fiscal deficit would reduce by GHS22.7 billion approximately 37% of the budgeted deficit.

Many economic analysts had genuine concerns about how the government was going to finance the fiscal deficit. In the budget presentation, the finance minister was not very clear on how the deficit would be funded. The budget statement only indicated that the deficit would be financed by other sources of financing including financing from multilateral and other international partners in the context of the IMF support. Our major concern was the government relying yet again on the Bank of Ghana to finance the budget as the bank did for the 2022 budget except that it would be doing so from a weaker position. With inflation rate currently at 54.1% and international reserves worth only 1.5 months of import cover, the Bank of Ghana simply lacks the fire power to provide the needed fiscal support. A significant participation in the DDE in this context would give the government the much-needed fiscal space in the attempt to restore debt and macroeconomic sustainability as well as secure IMF financial assistance.

Written by:

Dennis Nsafoah

Assistant Professor of Economics

Niagara University, NY

Member of Research Committee, Tesah Capital

&

Elikplimi Komla Agbloyor

Associate Professor, Department of Finance, University of Ghana Business School.

Chair of Research Committee, Tesah Capital

Data Scientist (Machine Learning and Artificial Intelligence Applications in Business)