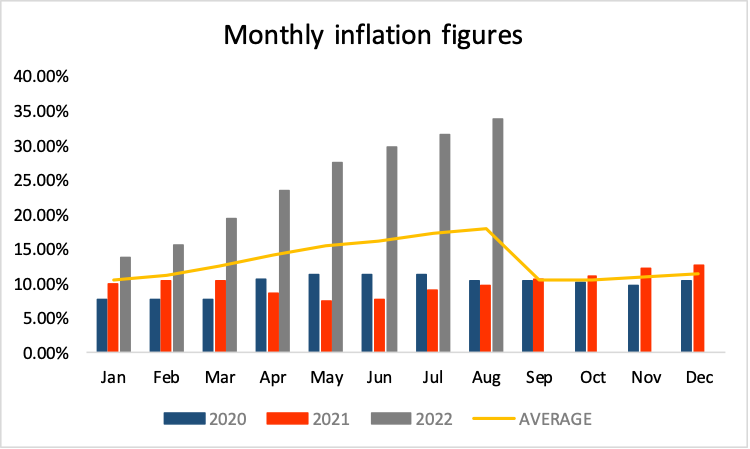

The headline inflation in August was 33.9% an increase of 2.2 percentage points from the 31.70% recorded in the month of July making it the highest in 21years. In addition to this, the 33.9% inflation recorded in August accounted for a 15 consecutive monthly rise in inflation.

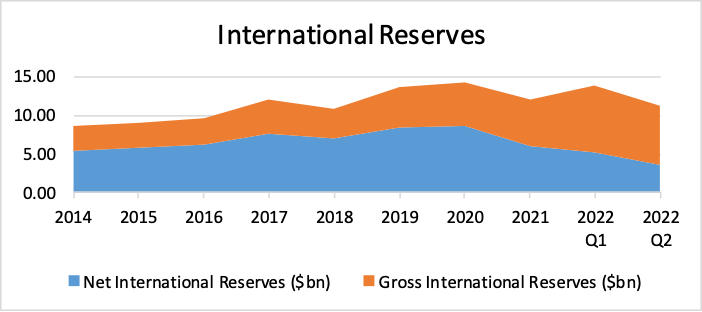

The August inflation window recorded upward pressures from imported inflation in both food and non-food inflation. This was aggravated by the decline of the foreign exchange reserves of the Bank of Ghana as demand for forex from individuals and institutions went up leading to about 15% depreciation of the cedi.

Figure 1: International Reserve position

Source: Bank of Ghana and Tesah Research

The largest contributor to the recorded inflation was Non-Food inflation which accounted for 54.6%, rising from 31.3% in July to 33.6% in August. This resulted in a month on month increase of 2.3%. On the other hand, food inflation contributed 45.40% to the recorded inflation, increasing by 1.8% to 34.4% in August

Figure 2: Comparative Inflation figures

Source: Ghana Statistical Service and Tesah Research

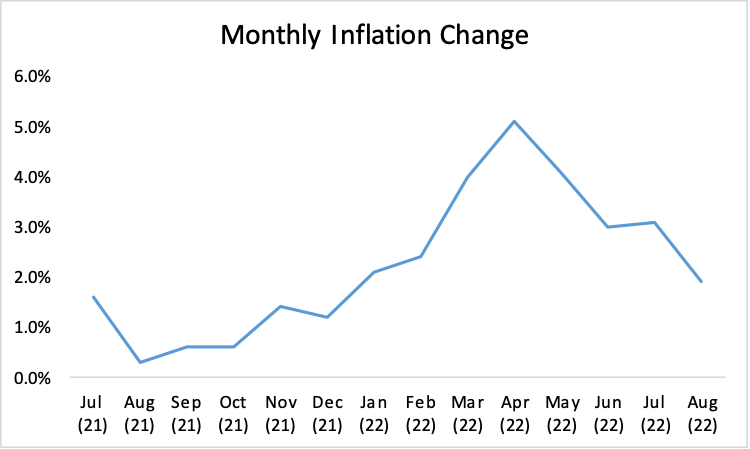

Expectations

We expect the inflation to increase further in the next reporting window. Though an increase is anticipated, the rate of increase is expected to slow down. This expectation is on the back of recent hikes in utility tariffs, expected public transport fare increases and expected depreciation of the cedi that is likely to arise as a result of pressure on the cedi prior to the Christmas festivities.

Figure 3: Month on Month inflation change

Source: Ghana Statistical Service and Tesah Research

The expected inflows from the cocoa syndicated loan are expected to shore up the foreign exchange reserves of the Bank of Ghana, which is likely to reduce the rate of depreciation of the cedi. This could reduce the effect on inflation. We also expect food inflation to record month on month declines due to the harvests from the major crop season.

We also expect an increase in monetary policy to tame the rising inflation by checking the supply of money which is a tool employed by Central Banks to manage aggregate demand for goods and services. Though the measures taken by the Monetary Policy Committee in the last emergency meeting are yet to be realized fully, they were more forward-looking and this could impact positively on inflation.