Data released by the Ghana Statistical Service (GSS) on July 13, 2022, indicate that the annual inflation rate increased to 29.8% in June 2022 from 27.6% recorded in May 2022. This is the highest level of inflation since December 2003, and almost 3 times the upper bound of the Bank of Ghana’s target range of 6% to 10%.

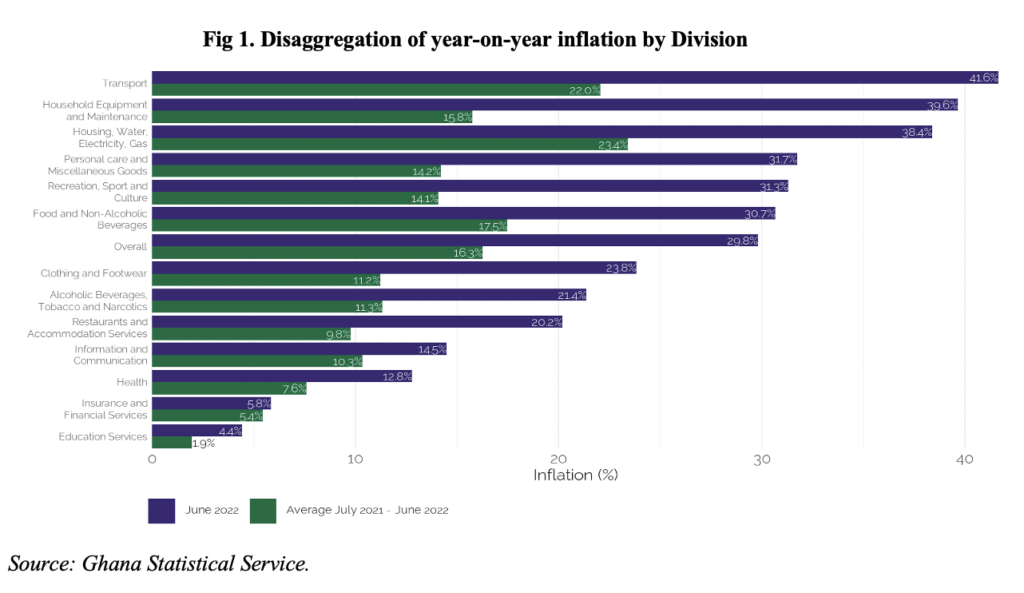

The increase in the Consumer Price Index (CPI) was broad-based. Food inflation was 30.7% compared to 30.1% recorded last month and 17.5% average over the last 12 months. Non-food inflation was 29.1% compared to 25.7% in May and 15.3% average over the last 12 months. Inflation for locally produced items was 29.2% while inflation for imported items was 31.3%. Of the 13 divisions that constitute the consumer basket, six recorded inflation rates higher than the headline inflation rate of 29.8%. Fig 1. below shows the disaggregation of year-on-year inflation by division.

–

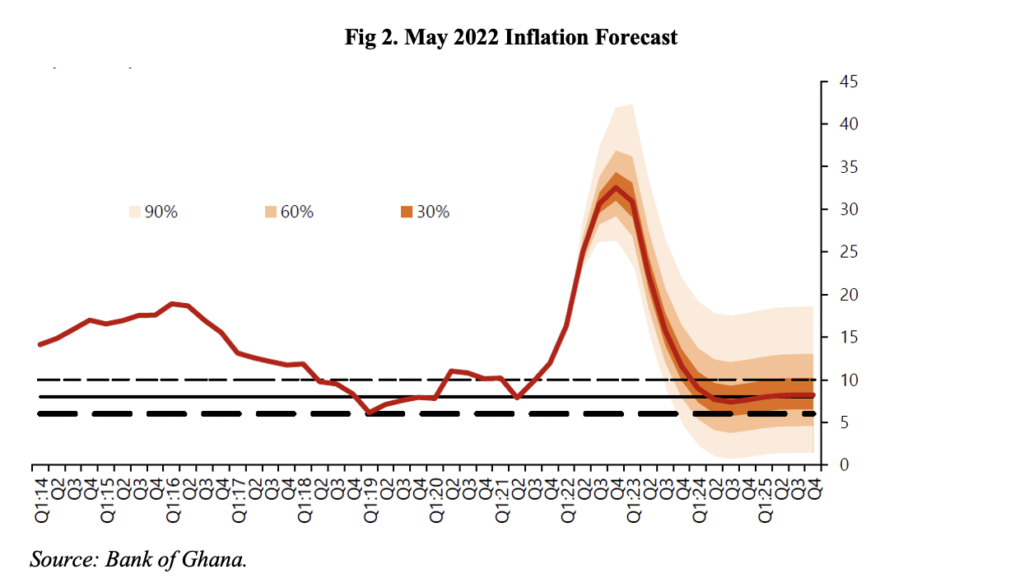

As high as an inflation rate of 29.8% is, it is still in line with market expectations. In the May 2022 monetary policy report, staff of the Bank of Ghana projected inflation rate to remain elevated above target until the second quarter of 2024. Fig 2 below shows the future path of Ghana’s inflation rate. Inflation is expected to peak at about 34% before the end of the year.

As a small open economy, Ghana’s inflation outlook is influenced by external factors in addition to domestic considerations. Global inflation and inflation expectation continue to remain elevated. In a related announcement, the Bureau of Labor Statistics (BLS) in the US reported that CPI inflation for June 2022 surged to 9.1% from 8.6% in May. This is the largest increase in US CPI inflation since November 1981. It will make a case for subsequent interest rate hikes in the US (and other advanced economies) and further tighten global financing conditions. If this happens, domestic inflation is likely to increase further in the coming months.

The broad-based nature of the inflation rate increases the pressure on the Monetary Policy Committee (MPC) of the Bank of Ghana ahead of their next policy rate decision on July 25th to increase the policy rate for a third time this year. In as much as there is evidence of external factors such as the war in Ukraine and continued supply chain disruptions driving inflation in Ghana, a broadened inflation also indicates excess demand in the economy. An increase in the interest rate will help slow demand and allow supply time to catch up. In January 2004, when the inflation rate was 29.0%, the policy rate stood at 21.5%, representing a real interest rate of -7.5%. With the current policy rate of 19%, history indicates the Bank of Ghana may further increase the policy rate to re-anchor inflation expectations and to prevent high inflation from becoming entrenched.

On the other hand, the MPC may decide to stay on the sidelines and maintain the policy rate at the current level of 19%. There are two main reason to explain such a decision. First, the MPC has already increased the policy rate by 550 basis points since November 2021. Most economists estimate that it takes an average of about 12 months for a monetary policy decision to be fully transmitted to the economy. In view of this, Ghana’s economy is yet to fully realise the full implications of the previous policy hikes. In addition, the June inflation of 29.8% is also within the Bank of Ghana’s forecast and may have already been anticipated in the previous policy rate hike of 200 basis points.

Whether the MPC decides to maintain the policy rate or increase it, we expect the next policy rate decision to do a good job of re-anchoring markets expectation of the near-term inflation rate. In the absence of (or in addition to) a decisive policy rate hike, the MPC should communicate the future path of the policy rate. If the central bank could share with the public what it considers as the neutral interest rate (the rate at which monetary policy is neither accommodative or contractionary), it would guide markets and anchor expectations around the inflation target.

Written by

Dennis Nsafoah

Assistant Professor of Economics

Niagara University, NY

Member of Research Committee, Tesah Capital