This article discusses how businesses can incorporate artificial intelligence and machine learning into their operations to improve business performance taking into consideration the role of the Board of Directors.

What is Corporate Governance and the Role of the Board?

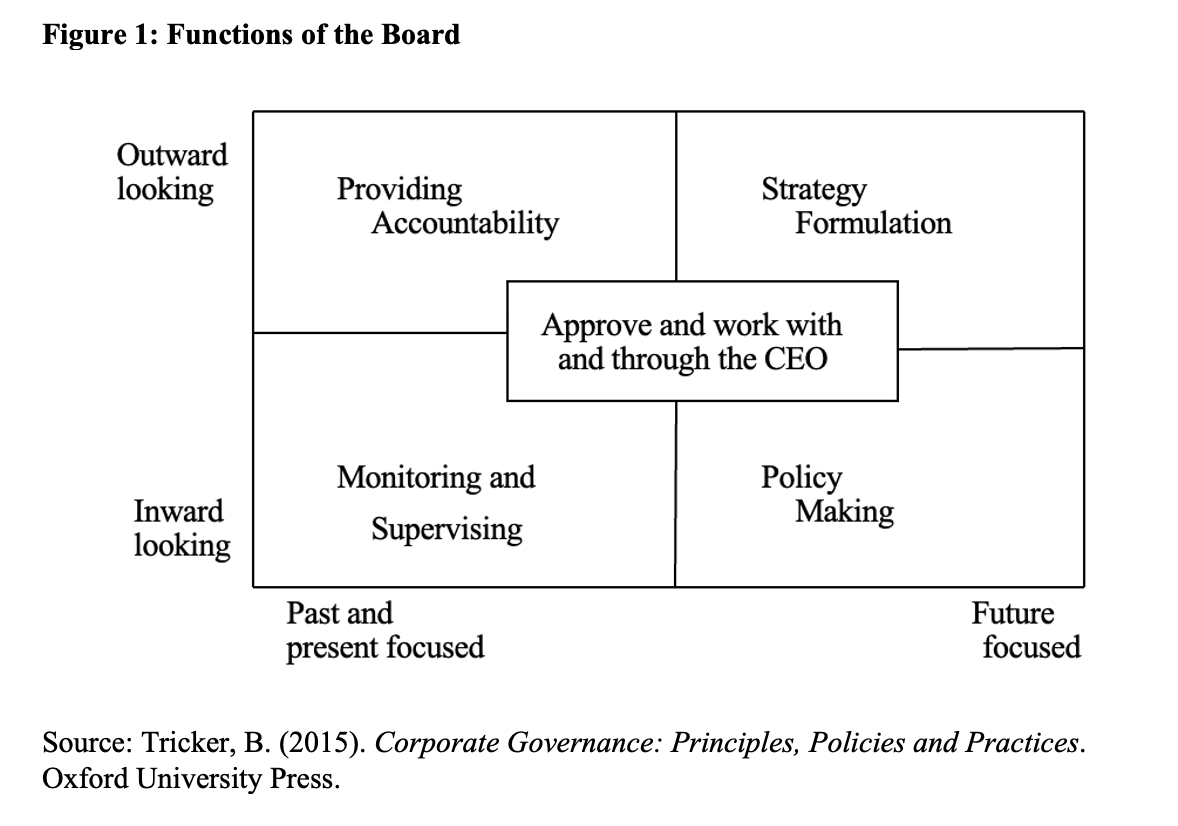

Corporate governance refers to how companies are directed and controlled. The Board of Directors is at the heart of corporate governance. The Board provides strategic direction to the firm. In terms of its broad functions or roles, the board is responsible for conformance and performance of the firm. Conformance refers to providing accountability to stakeholders and monitoring and supervising executive management. Providing accountability is past and present focused but its orientation is outward looking (focuses on external stakeholders). Monitoring and supervising executive management are past and present focused but its orientation is inward looking (focuses on the firm). The Board is responsible for performance of the firm – strategy formulation and policy making. When the Board is future focused and is looking outward, the Board focuses on strategy formulation and direction for the firm. On the other hand, when the Board is future focused but is inward oriented, the Board focuses on making policies to guide the firm. These functions are performed with and through the CEO. The extent of delegation varies by firm (the smaller box in Figure 1), however, the Board and not executive management is ultimately responsible for the performance of the firm.

Artificial Intelligence and Machine Learning: What is It?

Artificial Intelligence is training machines to behave like human beings. The machines thus possess intelligence, but this intelligence is artificial (not biological). Machine learning, unlike AI, refers to training machines to automatically learn from data and make decisions based on the data. AI and ML are fields that emanated from computer science but their applications have gained prominence in many fields including business.

Machine learning has three learning techniques: Supervised, unsupervised and reinforcement learning. Supervised learning is the most widely used learning technique. In all the learning techniques, data is split into two folds where one part is used as training and the other is used to test the performance of the machine learning algorithms. With supervised learning, there is a ‘target’ or ‘dependent’ or ‘label’ variable that we are interested in predicting. This variable may either be a discrete variable, continuous variable or a categorical variable (classification problems). A discrete variable assumes a countable number of values, whereas a continuousvariable is characterized by uncountable values within an interval. Examples of a continuous variables include the price of a house, stock prices, the exchange rate etc, whilst examples of discrete variables include the number of children, number of cars, number of employees etc. Examples of categorical variables are whether a customer defaults or not, whether a customer cancels a booking or not, and whether a transaction is fraudulent or not. The popular algorithms used in supervised learning with discrete and continuous variables are regressions. The popular algorithms used in classification problems are logistic regressions and decision trees.

In terms of unsupervised learning, there is no ‘target’ or ‘dependent’ or ‘label’ variable. Unsupervised learning basically groups the data into categories or clusters based on the distance between the various points in the dataset. I have used unsupervised learning to group stocks listed on the Ghana Stock Exchange for example into various categories. A supermarket can use unsupervised learning to group its customers into categories based on for example their income, how often they shop, how much they spend etc. The popular algorithms used in unsupervised learning include hierarchical clustering and K-means clustering.

The data scientist trains the algorithms to learn from the training data. The data scientist then tests the performance of the algorithms on the test or unseen data. Ideally, if our algorithms are working well, the performance in the training and test data will be similar. If the performance in the training data is high, but low in the test data it suggests that the models are over-fitting. In essence, the models are not very useful as they perform poorly on unseen or test data. Performance can only be determined with the test data as some algorithms have the tendency to overfit quickly on training data. On the other hand, if performance is low in the training data set and also poor in the test data, it suggests that our algorithms are underfitting.

The outcome of a machine learning algorithm is influenced by several factors including the quality of the data. However, in Africa, one of the challenges associated with the implementation of data analytics is the data quality. Thus, board of directors have a responsibility to develop and enforce policies that would maximize data quality. Quality of data largely depends on the skills of the data scientist/analysts and, of course, the mode of data collection. The data scientist improves the quality of data through a machine learning stage called Data pre-processing. Data pre-processing encompasses data cleaning, normalization and selection of features for machine learning algorithms to learn from. Feature selection reduces the number of input variables when developing a predictive model. The eliminated variable does not have strong predictive strength to improve the discriminative power of machine learning algorithms. While there are other feature selective techniques, the most widely used is the principal component analysis.

Business Use Cases of AI and ML

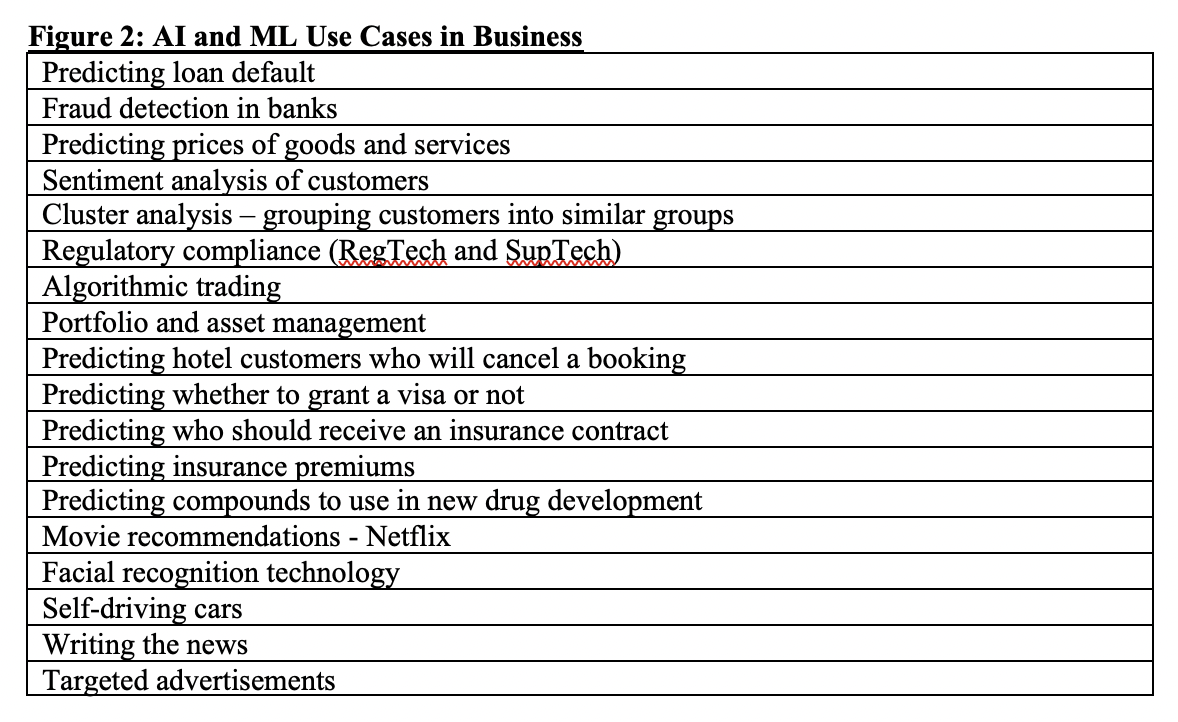

AI and ML can be used in so many applications in business. In this write up, I will highlight just a few areas in which businesses can deploy AI and ML. A bank may be interested in predicting clients who will default on a loan as against those who will not default. The data scientist will use the other ‘features’ or ‘independent’ variables in the data set such as number of transactions in a month, income, the size of the loan, how long the customer has been banking with the bank, whether the customer is employed or unemployed, and whether the customer has paid previous loans etc to predict the likelihood that the customer will pay a new loan or default. A bank may also be interested in predicting which transactions are fraudulent or involve money laundering and terrorist financing. Again, AI and ML algorithms can be trained to learn the characteristics of fraudulent transactions and predict which transactions in the future are likely to be fraudulent. A bank can also use sentiment analysis on its social media handles and websites to quickly identify negative sentiments which represent customers who may be dissatisfied with its services. This gives the bank the opportunity to intervene and prevent damages to its reputation.

An insurance company can use AI and ML to predict who it should issue an insurance policy to and who should not receive a policy. It can also use AI and ML to predict how much it should charge in terms of the premiums that clients should pay. A hotel may be interested in predicting which customers will cancel their bookings and those who would not. An Embassy can use AI and ML to automate its visa process by deciding who receives a visa and who does not. The algorithms will learn from past visa decisions. A manufacturer can use AI and ML to predict when parts will become faulty or fail. A pharmaceutical company can use AI and ML in new drug development by examining compounds that have been used in previous drugs and predicting which compounds can be combined to make new and effective drugs. Businesses can use AI and ML to predict the prices that they should charge for their products and services. AI and ML can be used to predict housing prices, stock prices, inflation, the monetary policy rate, the exchange rate, stock market liquidity etc.

Businesses such as Netflix use AI and ML in a recommender system to predict movies that a viewer may be interested in based on movies and series that they have watched in the past. The self-driving cars being developed now incorporate AI and ML to understand their surroundings. The car is trained to identify objects such as human beings and other obstacles on the road.

Businesses and regulators are using AI and ML to make regulations and compliance more efficient. RegTech refers to the industry using AI and ML to make compliance more efficient. SupTech refers to regulators using AI and ML to make the supervisory role more effective and efficient. AI and ML have the potential for automating consumer protection, market supervision, and prudential regulation. A regulator such as a Central Bank can use AI and ML to collect and analyze data in real time from regulated entities. It can consequently spot ‘potential’ problems and regulatory breaches more quickly and can thus intervene in a manner that protects the public and reduces the probability that a government bailout will be necessary.

Merits and Demerits of AI and ML

AI and ML has many merits and demerits. As mentioned previously, the Board of Directors is responsible for both the conformance and performance aspects of a business. The Board can use AI and ML as an ‘offensive’ tool to increase profitability, reduce cost, enhance efficiency, make the business more competitive and automate many routine transactions and processes. The Board can also use AI and ML as a ‘defensive’ tool to help meet its compliance requirements. Here, RegTech (regulatory technology) can play a leading role.

AI and ML, however, have some down sides. One huge disadvantage with these models is that there is a tradeoff between predictability and explainability. Models with very high predictability usually have less explainability. Consequently, even though very complex models are good at predictions they are basically black boxes as we cannot understand what influences the predictions. This limits the adoption and widespread usage of these models for example in a regulated entity such as a bank, insurance company or pension fund. Further, these models are not able to achieve perfect predictability and, in many cases, suffer from over-fitting.

AI and ML can perpetuate existing biases. For example, ethical AI requires that in modelling for example clients who should receive a loan, variables such as race, religion and, potentially, gender should be taken out. If not, for example in the U.S, black people are likely to receive less loans. As another example, women may be disadvantaged when it comes to loans. It can be difficult to ‘remove’ these variables from modelling though as the algorithm can pick up on gender based on a person’s shopping habits for example. The algorithms may also pick up on race based on where someone for example lives in the U.S though race has not explicitly been included in the modelling.

Businesses may be susceptible to cyber-attacks based on their increased use of technology. For example, SWIFT suffered an $81 million loss through a cyber event in 2016. There are also fears that technologies such as facial recognition can be abused and used to restrict and limit the freedoms of citizens. China, may be a prime example of a society where facial recognition and other technologies have been used to limit the freedom of citizens. There are also fears that human beings may be made redundant in the future as machines take over many of the roles being performed by humans.

How Can Boards Integrate AI and ML into the Business?

First of all, Boards need to understand what AI and ML is, their potential uses in their specific business setting, and the merits and demerits of AI and ML. Indeed, Boards can be guided by various theories such as the Technology Acceptance Model (TAM) propounded by Davis (1989) and its various extensions to make the adoption of AI and ML smoother in their business. TAM and its extensions posit that new technology will be adopted faster if it is perceived to be easy to use, if it is perceived to be useful, if users have trust in the system and the risk that users perceive from the system. There are many options of integrating AI and ML into the firm’s operations. The Board can appoint a Chief Technology Officer (CTO) who would work with data scientists to harness the power of data in the Board Room. The CTO may be a member of the Board or not. The Board may also use the services of a Technology Advisor (TA) who is not a member of the Board and has no voting rights. This person however can attend Board meetings and advice the Board on how it can deploy AI and ML to maximize shareholder value. The Board may also outsource or hire outside technology firms or consultants to help it roll out its innovation agenda. The Board may also introduce a Committee responsible for Innovation, Digitization and Technology. This Committee could be headed by a non-executive director who has significant knowledge and experience in the area of technological innovation. One size does not fit all though, and the options adopted by the Board will depend on the size of the business, the complexity of its operations, its regulatory environment, and its industry.

Once AI and ML is in place, the Board has to maintain governance of these systems. The model development process has to be documented and audited from time to time to ensure that they are working as intended. The output of these models should also be reviewed. The Board should also ensure that there are arrangements in place to monitor outsourced technological services as this may introduce third-party risks. Finally, there should be systems in place, for example for a bank customer or visa applicant, to appeal a decision made by a machine.

Written By;

Elikplimi Komla Agbloyor

Associate Professor, Department of Finance, University of Ghana Business School.

Chair of Research Committee, Tesah Capital

Data Scientist (Machine Learning and Artificial Intelligence Applications in Business)