In the previous two parts of this essay, I discussed the governments plan to achieve debt sustainability by 2025 and the realism of this plan. Crucial to the plan is realising “oil discovery-like” change in revenue. I also argued that the plan is unrealistic, and the government of Ghana is likely to request for an IMF intervention in a couple of years. In this last part of the essay, I will discuss the impact of the new 1.75% levy on all electronic transactions including mobile money (Momo) payments on the objective of slowing down debt accumulation in Ghana.

The E-levy is the most contentious aspect of the 2022 budget. It was the reason why the budget was first rejected by lawmakers in the first attempt to get the budget passed. You may recall from the first part of this essay that the government’s plan to achieve debt to GDP ratio of less than 70% in 2025 is to realise an oil discovery-like change in revenue. Part of that realisation comes from the new 1.75% levy on electronic transactions. From Budget 2022, the government expects to receive a cumulative e-levy of GHS 33.8 billion from 2022 to 2025. Whereas majority of Ghanaians are in support of the minority in parliament’s proposal for the e-levy to be scrapped, some civil society organisations and economists have suggested to the government to reconsider a 1% levy instead of the proposed 1.75%.

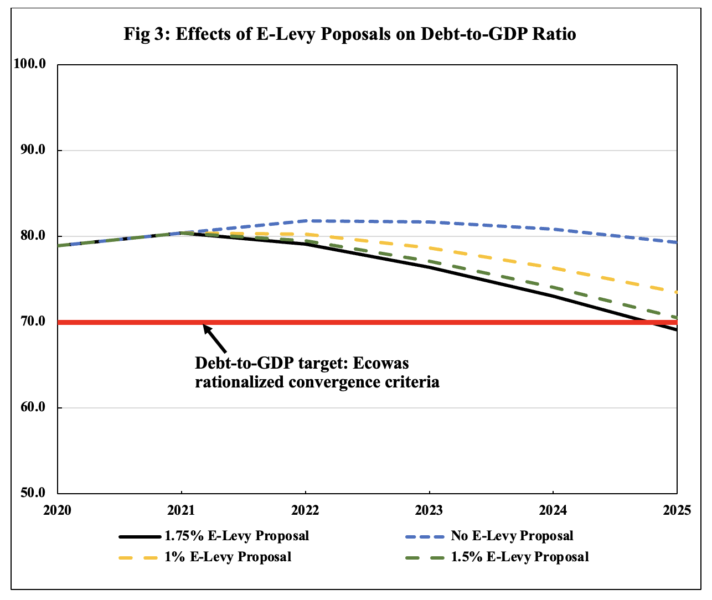

Source: Ministry of Finance and author’s own calculations

In Fig 3, I show the effects of various e-levy proposals on the debt to GDP ratio. I must emphasize that Fig 3 assumes that every other target of the government remains constant except the changes in the e-levy. It can be observed that scrapping the e-levy from budget 2022, as proposed by the minority in parliament without a significant change in other parts of the budget, will lead to dire consequences in achieving sustainable debt levels by 2025. The debt to GDP ratio with no e-levy is estimated to be 79.3% by 2025. Similarly, 1% e-levy as proposed by some civil society organizations and some economists will also be insufficient to achieve a less than 70% of debt-to-GDP by 2025[1].

In addition, I also analysed a 1.5% e-levy proposal instead of the 1.75%. A 1.5% proposal shows a significant reduction in Ghana’s debt to GDP ratio by 2025. However, it still falls short of achieving a debt to GDP ratio of less than 70% by 2025. The above analysis suggests that the government’s plan as laid out in budget 2022 to achieve a sustainable debt level by the end of 2025 is unachievable without the controversial 1.75% levy on electronic transactions. In as much as I think the plan in its current form (including the 1.75% e-levy) is unrealistic, without the e-levy the government will need to come up with a different plan.

Written by

Dennis Nsafoah

Assistant Professor of Economics

Niagara University, NY

Member of Research Committee, Tesah Capital

[1] The budget states that the government expects to accrue about GHS 33.8 billion over the medium term from the e-levy. I assumed if they could accrue that amount with 1.75%, then using simple proportions I computed how much they can get from 1% and 1.5%. I basically assumed linearity in revenue projection.