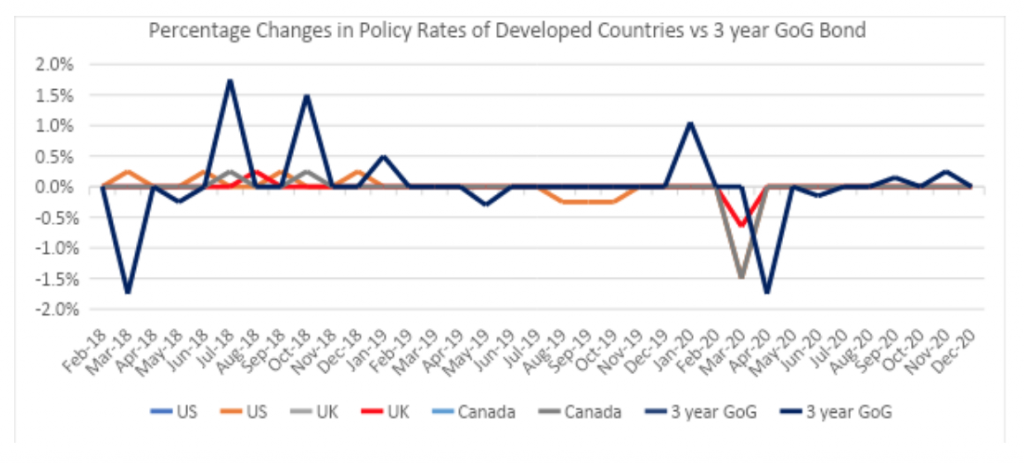

Data from the Central Securities Depository (CSD) indicated a strong resumption of capital flows into the capital markets throughout the fourth quarter of 2020 (see Fig. 1 below). Some analysts attributed the strong capital inflows to increased optimism about Ghana’s economic growth, amid easing trade tensions between the United States and China. Some analysts have signaled macroeconomic policies, particularly low interest rate spread as the primary driver. That is, interest rates are usually higher in developing countries like Ghana.

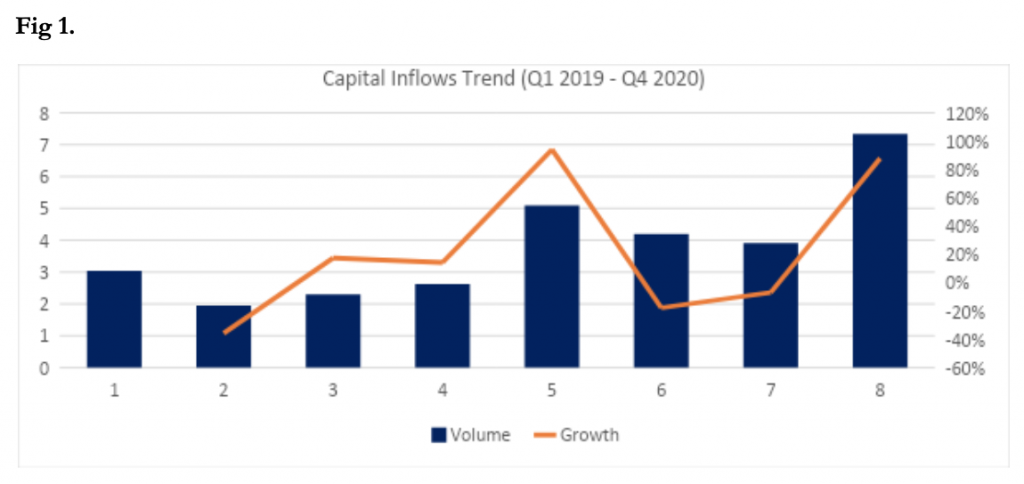

The onset of the Covid-19 pandemic in Ghana in March, 2020, led to dramatic outflows from the capital markets, particularly the equity market (see Fig. 2 below). Total portfolio flows reversed in the second quarter of 2020, with more than GHS 69 million exiting the Ghana Stock Exchange. This heightened the already existing uncertainties induced by the Covid-19 pandemic for local investors.

The fourth quarter of 2020 however witnessed a renewed interest in the Ghanaian capital market. This follows expectation of a gradual recovery in macroeconomic indicators resulting from the adverse impact of Covid-19 pandemic. Additionally, expansionary monetary policies that were adopted by many developed countries following the Covid-pandemic resulted in low-yielding global debt. This contributed to an increase in investors’ appetite to search for higher yields in developing countries such as Ghana.

Equity market turnover increased by 105.75% in the last quarter of 2020 to 291 million shares valued at GH¢ 280.07 million, despite the Ghana Stock Exchange Composite Index (GSE-CI) losing 13.98% of its value at the end of the year. Foreign investors equity purchases surged by 214.40% q/q to GHS 165 million, over the same period (versus 11.25% q/q decline in 3Q 2020). Meanwhile, trading volume on the Ghana Fixed Income market ended the year 2020 at GH¢108.41 billion, above the GHS 100 billion ceiling for 2020. Foreign investors purchase of fixed income securities increased by 86.18% q/q in 4Q 2020 (versus 6.79% q/q decline in 3Q 2020).

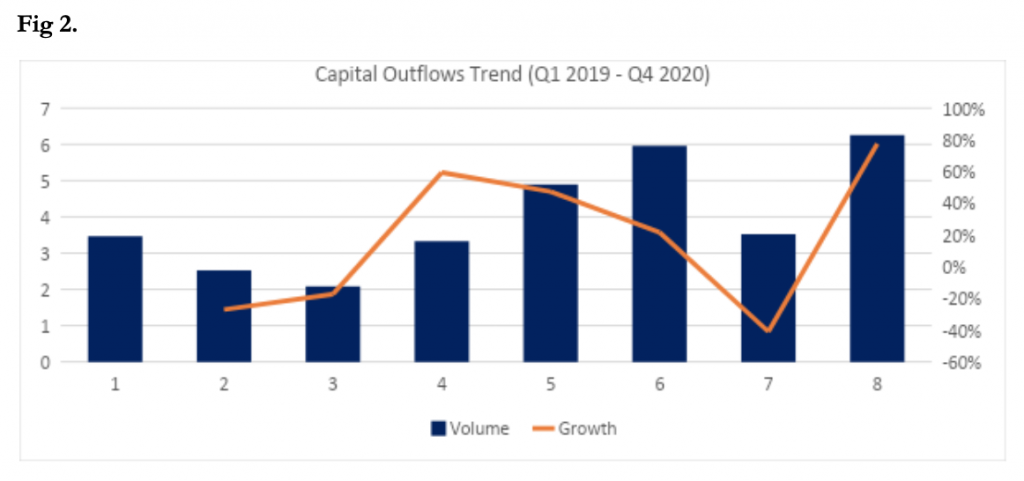

Despite the conventional view that, foreign portfolio inflows could reduce borrowing cost and ultimately contribute to economic growth and development, reliance on foreign financing may increase the country’s vulnerability and fragility to sudden reversals in capital flows. A key risk for the local markets going forward is the potential shift in policy stance (from an expansionary to a tightening position) of central banks in developed countries. In a situation, where sovereign securities of developing countries are considered risky, yields on GoG would have to rise higher than that of other securities, considered less risky. We observed (see Fig 3 below) that interest rates on GoG Bonds (3-year bond) have tended to move in the same direction (positively correlated) as the changes in central banks rate of selected developed countries. A reversal from the loosening cycle could therefore create the condition for capital inflows to ebb. To the extent that foreign investors holdings of financial assets affect macroeconomic policies, a reversal in capital inflows may have negative macroeconomic effects including, falling currencies, rising interest rates amongst others.

Data from the CSD indicated that, total portfolio inflows have returned to pre-covid levels. Foreign investors participation in the local market increased significantly to GHS 4.37 billion in 4Q2020 compared to GHS 3.86 billion and GHS 3.10 billion in 4 Q2019 and 4 Q2018 respectively. The recent increase in the holdings of financial assets on our local market by foreigners should therefore be viewed with concern, particularly portfolio flows.

Fig 3. Percentage Changes in Policy Rates of Developed Countries vs 3 year GoG Bond