The year 2020 started out on a good note for most African stock markets, with opportunities and investment prospects catching the attention of both local and foreign investors. The outbreak of the COVID-19 pandemic, however, resulted in a reduction in market activities and various indexes turned red by close of year 2020. Selling pressures intensified and bearish sentiments plagued various markets in general throughout the year.

However, some indexes on the continent managed to thrive, with some recording substantial market returns over the period. In this report, seventeen (17) randomly selected stock exchanges in Africa were analyzed to determine the best and worst performing bourses on the continent in 2020.

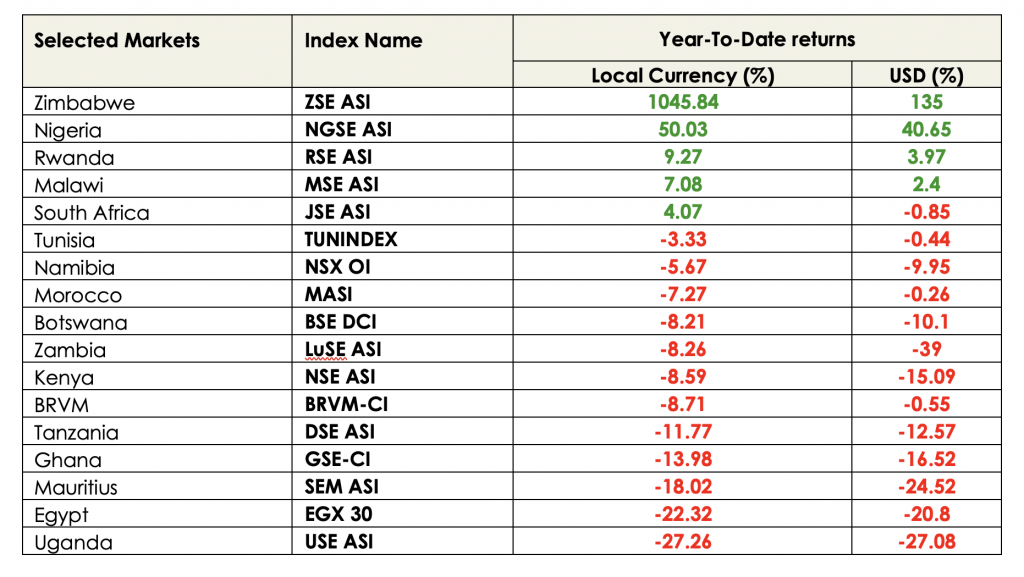

Below is a table showing the performance of selected stock exchanges on the African continent as at December 31, 2020.

From Table 1 above, the Zimbabwean Stock was the best performing exchange in 2020 as its main index, the Zimbabwe All Share Index (ZSE-ASI), jumped by 1,045.84% year-on-year in local currency terms. In dollar terms, the ZSE-ASI increased by 135% year-on-year over the period. The devaluation of the Zimbabwe’s currency in June, 2019 may have induced investor capital injection into listed companies.

Three other indexes on the continent, the Nigerian Stock Exchange’s All Share Index (NGSE ASI), Rwandan Stock Exchange’s All Share Index (RSE ASI), and Malawian Stock Exchange’s All Share Index (MSE ASI), witnessed positive performances in both local currency and dollar terms as shown in the table above. The NGSE ASI, RSE ASI and MSE ASI grew by 50.03%, 9.27% and 7.08% respectively in 2020, bolstered by increased investor appetite for equities amid prevailing low yields on fixed income instruments and relatively stable macroeconomic fundamentals.

Further, Johannesburg Stock Exchange’s All Share Index (JSE-ASI) posted a 4.07% return in local currency terms. However, the depreciation of the South African Rand against the US dollar caused the index to close on a negative note (-0.85%) in dollar terms at year end.

The remaining exchanges taken into account were found in red territories at the end of the year. The worst performing index analyzed was the Ugandan Stock Exchange’s All Share Index (USE ASI), which lost 27.26% of its value in local currency terms. In dollar terms, the Lusaka Stock Exchange (LSE) in Zambia posted the least returns (-39%) among African stock market indices.

The Ghanaian Stock Exchange Composite Index (GSE-CI) recorded a -13.98% return in local currency terms and a -16.52% return in dollar terms at the end of the year. Selloffs by foreign investors who control a significant portion of the market increased as the impact of Covid-19 on the economy as well as recovery from the financial sector crisis intensified the already bearish market. The Ghanaian bourse however witnessed an improvement in its performance in the last quarter of 2020, as investor appetite rebounded emanating from improvements in economic activities and growth prospects. We expect the anticipated rebound of the economy to sustain the recovery of the market in 2021.