A central bank is an institution responsible for formulating monetary policy to achieve price stability and help manage economic fluctuations. In the wake of the economic downturn of the Covid-19 pandemic, central banks globally responded with unprecedented monetary accommodation to mitigate the impact of the pandemic shock on households and businesses. The Financial Stability Board (FSB) reports that there was a $7 trillion increase in central bank assets globally in the first 8 months of the Covid-19 pandemic.

Central Banking, the organizers of the seventh annual central banking awards, named the Bank of Ghana (BoG) as the 2020 central bank of the year. This is a great honour done to the Bank of Ghana, given the extraordinary measures implemented by several other central banks across the globe including the US Federal Reserve, the European Central Bank (ECB), the Bank of England (BoE) and the Bank of Canada (BoC). The criteria to be considered for the award included fulfilment of Mandate and pioneering work and policy innovation. In this article, we will analyse the performance of BoG for the year under review based on its mandate.

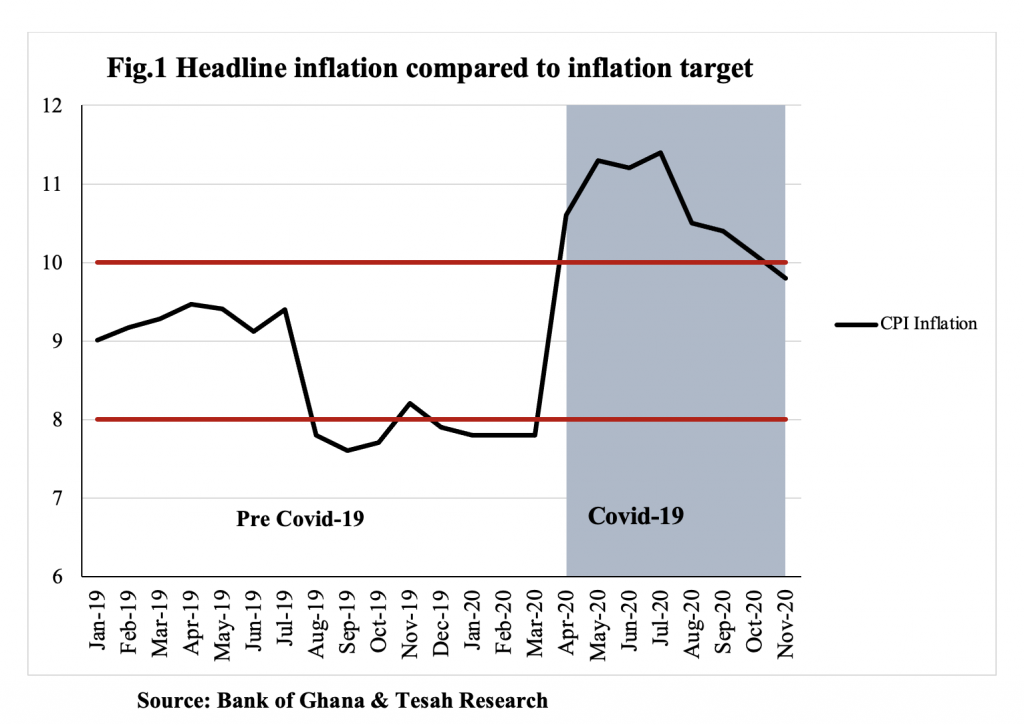

The primary objective of the Bank of Ghana is to maintain price stability. Currently, the Bank’s inflation target is 8% with a symmetric band of 2%. In Fig.1, we show the monthly CPI inflation (black line) compared to the inflation target range (red lines).

The headline inflation rate was within the target range before Covid-19. Inflation in Ghana increased beyond the target range due to the supply shocks of the pandemic. It is worth emphasizing that the inflation rate returned to within target in November 2020 well ahead of expectation. In a period where major central banks globally are struggling to keep inflation within target, the Bank of Ghana managed to return inflation ahead of schedule. In the September 2020 monetary policy report, the economists at the Bank expected inflation to return to target by the second quarter of 2021.

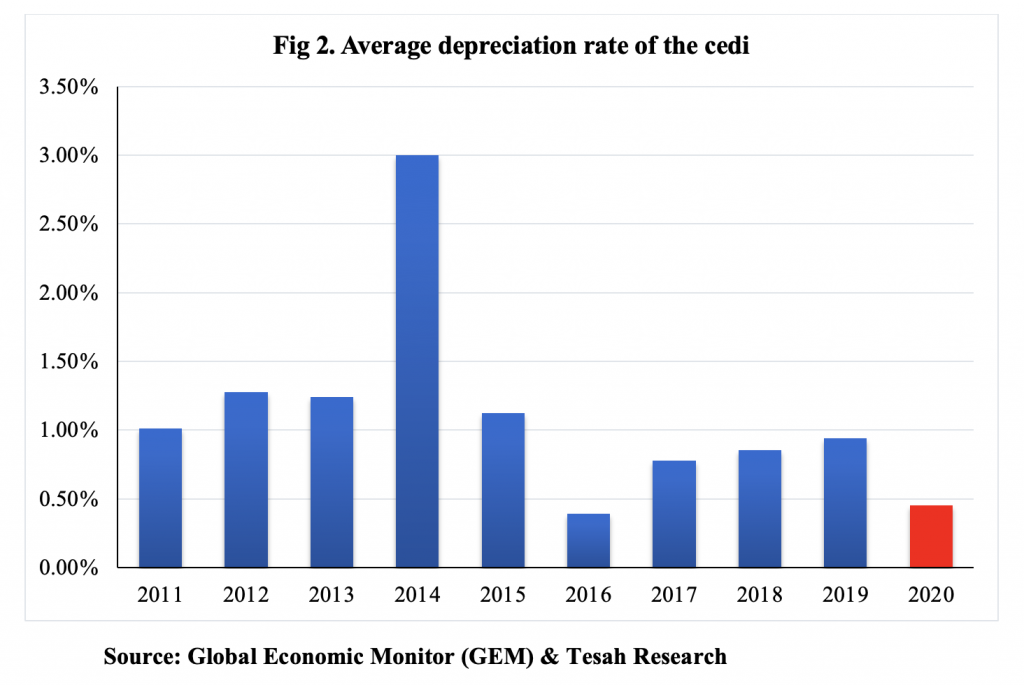

At the heart of the price stability mandate of a small open economy, like Ghana, is a well anchored exchange rate. In this paragraph, we analyse the performance of the cedi relative the US dollar.

The cedi recorded one of the best performances in the last decade in 2020. The average monthly depreciation rate of 0.45% in 2020 is only second to 2016, when the cedi depreciated by an average of 0.39%. Fig 2 shows an increasing upward trend in the average rate of depreciation from 2016 to 2019. The trend however was defied by the strong performance of the Ghanaian currency in 2020. The cedi stability in 2020 can largely be attributed to the relatively tighter monetary policy stance of the Bank of Ghana. In a year which saw the US Federal Reserve reduce its policy rate to near zero and a subsequent unprecedented asset purchase program (which increased the Feds balance sheet to over $7.3 trillion representing 35% of GDP), the Monetary Policy Committee (MPC) of the Bank of Ghana only reduced its policy rate once (out of the 6 scheduled MPC meetings) by 150 basis points in March 2020. In subsequent meetings, the MPC kept the policy rate unchanged but the Bank purchased a 10-year government of Ghana bond with a face value of 10 billion cedis (representing 2.6% of GDP).

The success of the Bank of Ghana in 2020, goes beyond fulfilling its price stability mandate. The central bank of Ghana has been successful in implementing several macro prudential policies to maintain financial stability in Ghana. In 2020, BoG successfully concluded three years of banking sector reforms which saw an increase in the minimum capital requirements. The clean-up of the financial sector led to the revocation of licences of weak and insolvent institutions, and a revamp of the regulatory framework to stabilise and strengthen the sector.